Content

This means that a company doesn’t take a long time to convert balances from accounts receivable to cash flow. They’re collecting payments from customers more steadily and efficiently. The average collection period is calculated by dividing a company’s yearly accounts receivable balance by its yearly total net sales; this number is then multiplied by 365 to generate a number in days.

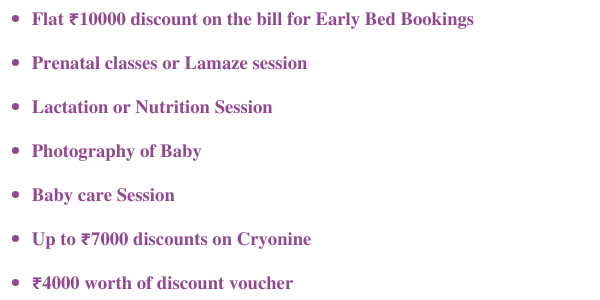

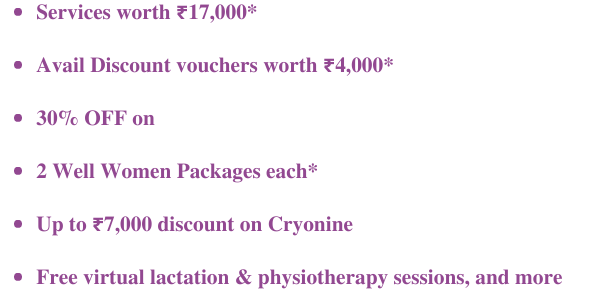

The Average Collection Period is the time it takes for companies to collect payments owed by their customers. A lower average collection period is better for the company because it means they are getting paid back at a faster rate. This allows them to have more cash on hand to cover their costs and reinvest in the business. The car lot records $58,000 in cash sales and $120,000 in accounts receivable at the end of the year. This gives them 37.96, meaning it takes them, on average, almost 38 days to collect accounts.

What Is an Average Collection Period?

In this example, first, we need to calculate the average accounts receivable. General economic conditions could be impacting customer cash flows, requiring them to delay payments to their suppliers. This issue is a major one, since the problem arises entirely outside of the business, giving management no control over it. Days sales outstanding is a measure of the average number of days that it takes for a company to collect payment after a sale has been made. A lower average collection period is generally more favorable than a higher one.

This has been a guide to Average Collection Period Formula, here we discuss its uses along with practical examples. We also provide you with the Average Collection Period calculator along with a downloadable excel template. If the company decides to do the Collection period calculation for the whole year for seasonal revenue, it wouldn’t be just. Free Financial Modeling Guide A Complete Guide to Financial Modeling This resource is designed to be the best free guide to financial modeling! Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics.

Average Collection Period: Definition

If a business’s liquidity is decreasing, it may check the average collection period to see if that’s the reason behind the declining liquidity. If a business’s average collection period is improving, but its liquidity is getting worse, then that means the business is having issues in other aspects of its business. Let’s say that at the beginning of a fiscal year, company ABC had accounts receivable outstanding of $46,000. At the end of the same year, its accounts receivable outstanding was $56,000. That means the average accounts receivable for the period came to $51,000 ($102,000 / 2). First, the average balance of accounts receivable needs to be computed by adding the beginning AR balance and the ending AR balance and then dividing it by two which is $72,500 (($65,000 + $80,000)/2).

How do you manage a collection team?

- Accept more credit cards.

- Send automatic notices for accounts coming due.

- Put the collections department on one strategy.

- Automated daily task lists.

- Treat your collectors more like a sales organization.

The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets. The collection period is the time that it takes for a business to convert balances from accounts receivable back into cash https://www.bookstime.com/ flow. This can apply to an individual transaction or to the business’s overall transaction history for a period of time. The lower this number, the more efficient the business is at collecting payment from its customers.

average collection period

The average collection period or DSO of a business is critical for its growth. If a company consistently has high ACP, there is a problem with its accounts receivable and collection process. By automating them with HighRadius Autonomous Receivables, businesses can significantly improve their order to cash cycle. Preauthorized checks are often used by businesses that receive payments from their customers at the same time and for the same amount each month. Preauthorized checks are typically used to pay mortgage and other financing obligations, insurance premiums, utility payments, and payments for many other services.

The 2nd portion of this formula is essentially the % of sales that is awaiting payment. The % of sales awaiting payment is then used as the % of time awaiting payment throughout the period. From here, the % of time awaiting payment is converted into actual days by multiplying by 365. Constantly calculating your average collection period can seem like a tedious task, but you don’t have to do it yourself.

For most businesses, the time it takes to collect on a customer’s account is generally the step requiring the most amount of time in the cash conversion period. The time it takes your business to collect your accounts receivable is measured by the average accounts receivable collection period. This average defines the relationship between your accounts receivable and your cash flow. The average collection period is the number of days in a given period that it takes for a company to collect money from its customers. It is calculated by dividing the accounts receivable balance at the end of the period by the average daily sales for the period. The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable and dividing it by the net Credit Sales.

How to Calculate and Reduce Inventory by Reduced Cycle Time

In the first formula, we first need to determine the accounts receivable turnover ratio. For the company, its average collection period figure can mean a few things.

A former editor of the “North Park University Press,” his work has appeared at scientific conferences and online, covering health, business and home repair. Fondell holds dual Bachelors of Arts degrees in journalism and history from North Park University and received pre-medical certification at Dominican University.

- A former editor of the “North Park University Press,” his work has appeared at scientific conferences and online, covering health, business and home repair.

- The lower this number, the more efficient the business is at collecting payment from its customers.

- The Average Collection Period is the time it takes for companies to collect payments owed by their customers.

- In order to calculate the average collection period, the company’s accounts receivable (A/R) carrying values from its balance sheet are needed along with its revenue in the corresponding period.

- On an average, the Jagriti Group of Companies collects the receivables in 40 Days.

- To calculate the average collection period formula, we simply divide accounts receivable by credit sales times 365 days.

Net credit sales are the total of all credit sales minus total returns for the period in question. The Average Collection Period ratio is often shortened to “average collection period” and can also be referred to as the “ratio of days to sales outstanding.” If the company had a longer average collection period, they would have to revisit their credit collection policies and the credit terms provided to their customers. How efficient and effective a management’s Accounts Receivable process is, is determined by how well accounts receivable balances are collected. Property management and real estate companies would also need to be constantly aware of their average collection period. In property management, almost their entire cash flow is done on credit and dependent on tenants paying their rent monthly.

My Account

It even amounts to the accounts receivables for a certain accounting period. The average collection period indicates the effectiveness of a firm’s accounts receivable management practices. It is very important for companies that heavily rely on their receivables when it comes to their cash flows. Businesses must manage their average collection period if they want to have enough cash on hand to fulfill their financial obligations. The average collection period is closely related to the accounts turnover ratio, which is calculated by dividing total net sales by the average AR balance. Receivable Turnover Ratio or Debtor’s Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts.

This electronic system eliminates the check-processing steps for both you and your bank. Once you’ve received the necessary authorization from your customers, your bank prepares a computerized list of your scheduled customer payments. The computerized list contains the information required to carryout the electronic transfer of the funds from your customers’ accounts for deposit into your account.

Since we are focusing on credit collection, this would not apply to cash sales. To incentivize faster payments, you can offer discounts if the client pays within a specific time frame.

- Your average collection period will depend on the type of business you run.

- This is, of course, as long as their collection policies don’t turn away too many potential renters.

- The average collection period should be closely monitored so you know how your finances look, and how this impacts your ability to pay for bills and other liabilities.

- Let’s say that at the beginning of a fiscal year, company ABC had accounts receivable outstanding of $46,000.

- For example, an average collection period of 25 days isn’t as concerning if invoices are issued with a net 30 due date.

Accounts receivable is a business term used to describe money that entities owe to a company when they purchase goods and/or services. AR is listed on corporations’ balance sheets as current assets and measures their liquidity. As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows. Company ABC is a retail company that operates in the home appliance industry.

From the course: Running a Profitable Business: Understanding Financial Ratios

One of the ways that companies can raise their sales is to allow their customers to purchase goods or services payable at a later time. Because of this, the key to measuring your average collection period is to do it regularly. If you notice your average collection period jump from 22.8 days to 32.8 days, that could have big effects on your cash flow and you’ll want to take steps to keep that upward trend from continuing. Net credit sales is the total of all sales made on credit less all returns for the period. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. If you are having trouble paying your bills, it’s essential to look for ways to improve cash flow.

You should also compare your company’s credit policy with the average days from credit sale to balance collection to judge how well your firm is doing. If the average collection period, for example, is 45 days, but the firm’s credit policy is to collect its receivables in 30 days, that’s a problem. But if the average collection period is 45 days and the announced credit policy is net 10 days, that’s significantly worse; your customers are very far from abiding by the credit agreement terms. This calls for a look at your firm’s credit policy and instituting measures to change the situation, including tightening credit requirements or making the credit terms clearer to your customers. A lower average collection period indicates the company is collecting payments faster, which sounds great in theory, but there is a downside in collecting payments too fast.

The average collection period must be monitored to ensure a company has enough cash available to take care of its near-term financial responsibilities. Becky just took a new position handling the books for a property management company. The business has average accounts receivable of $250,000 and net credit sales of $400,000 with 365 days in the period. Because their income is dependent on their cash flow from residents, she wants to know how the company has been doing with its average collection period in the past year.

Compared to Previous Years’ Ratios

At the beginning of this year, Bro Repairs accounts receivables were $124,300 and by the end of the year the receivables were $121,213. As was the case with a tighter credit policy, this will also reduce sales, as some customers shift their purchases to more amenable sellers. The measure is best examined on a trend line, to see if there are any long-term changes. In a business where sales are steady and the customer mix is unchanging, the average collection period should be quite consistent from period to period. Conversely, when sales and/or the mix of customers is changing dramatically, this measure can be expected to vary substantially over time. Let’s say that Company ABC recorded a yearly accounts receivable balance of $25,000. An average collection period of 30 days for a company indicates that customers purchasing products or services on credit take around 30 days to clear pending accounts receivable.

- Understanding what a low or high collection period means will give you an idea of where your company stands financially and project where they need to improve to avoid future challenges.

- A high ACP can indicate that a company is having difficulty collecting payments from its customers, which may lead to liquidity problems.

- Being assured that your customers pay on time makes your cash flow more predictable and easier to manage.

- A lower average collection period is better for the company because it means they are getting paid back at a faster rate.

Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She was a university professor of finance and has written extensively in this area. This will also provide an indication of the company’s ability to make larger purchases in the future.

Depending on the locations of your customers, not having to rely on the postal service for the delivery of their payments can reduce your cash conversion period by one to three days. Cutting down on any postal delays caused by having your customers’ payments delivered to your business address. Plus, someone from your business is going to have to take those payments to the bank for deposit.

The first equation multiplies 365 days by your accounts receivable balance divided by total net sales. You can understand how much cash flow is pending or readily available by monitoring your average collection period. Measuring this performance metric also provides insights into how efficiently your accounts receivable department is operating. Upon dividing the receivables turnover ratio by 365, we arrive at the same implied collection periods for both 2020 and 2021 — confirming our prior calculations were correct. In the next part of our exercise, we’ll calculate the average collection period under the alternative approach of dividing the receivables turnover by the number of days in a year.